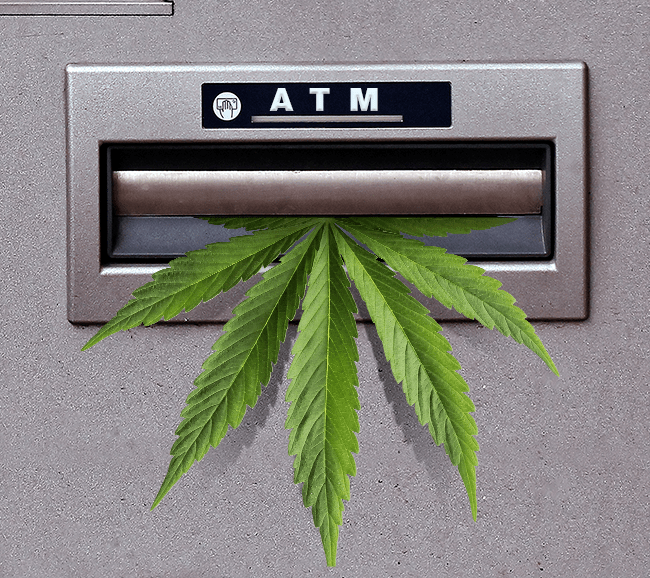

How many federally-insured banks are officially and openly friendly to the cannabis industry?

Updated as of April 2021

Register here for realtime email updates (Coming Soon!)

How does Fincann measure the number of cannabis-friendly institutions?

This published data is based upon Fincann direct real-time market intelligence, collaboration with our pioneering colleagues, and banks in our Cannabis Banking Financial Network. Our frontline experience over the past five years indicates that there are approximately 10% more active THC licensee and general cannabis industry-friendly banks, and 20% more active CBD| hemp-friendly banks in addition to those we are directly aware of since we cannot know of every one that recently came on board via the good offices of our colleagues’ continuing efforts. Fincann is confident that our adjusted data is reliable, actionable and the industry’s first and best measure of actual current compliant industry-friendly banking.

Many banks provide services to more than one key sector so the figures overlap and the individual sectors total more than the total.

Only federally-insured financial institutions offering transparent, fully-compliant programs are included in our report; there are at least several dozen banks offering questionably sustainable service only to limited existing customers, as well as banks that accept industry customers with inadequate compliance protocols, reporting and transparency – none of these are included in our data. Also we have not included ‘virtual banks’ or ‘fintechs’ in our reporting, limiting the results to those with actual brick & mortar facilities.

Many in the cannabis and banking industries often refer to periodic FinCEN reports of marijuana-related suspicious activity report (SAR) filings, which they inaccurately interpret as evidence of many hundreds of banks servicing the industry. For example, these reports include SARs filed to notify FinCEN that the bank discovered an undesired marijuana-related customer and terminated the account, or a landlord now leasing one of their commercial spaces to a THC licensee (which they may or may not have decided to maintain the account). Such filings obscure the results leading to false interpretations.

Additionally, FinCEN guidelines do not call for filing SARs, except in instances of banking or terminating THC licensees who cultivate, manufacture, or dispense marijuana. SARs filed relating to any other sector -- including landlords, ancillaries, test labs, and other business entity types -- should not be filed. However, due to misinformation, many SARs are improperly filed with respect to customers outside the FinCEN guidelines, further skewing the results. None of these and many other such filings shown in these FinCEN reports evidence that the financial institution is actively, compliantly and sustainably supporting THC licensees or any other industry sectors.

How does the Cannabis Banking Financial Network fit into this?

Since 2015, Fincann has built and now offers our clients exclusive access to our proprietary network of financial institutions that are openly and sustainably banking cannabis, CBD, and hemp business. Out of the institutions mentioned above, our growing consortium works closely with more than 125 of them, connecting cannabis industry sectors of all types with the right financial institution for their needs. Through the Cannabis Banking Financial Network, your business can access a full range of commercial banking services, knowing with confidence that the institution is friendly and open to banking cannabis businesses.

As a Fincann client, we will connect your business with these banking partners that not only accept, but welcome, your cannabis, CBD, or hemp related business without covers or workarounds. Because our institutions welcome your business, there’s no longer a worry that you’ll be dropped or your account closed without warning.

The services offered in the Cannabis Banking Financial Network include:

FI and Fintech companies: Connect with the cannabis industry

Fincann wants to connect you with cannabis industry customers. Our firm partners with banking and payment solutions to introduce their compliant banking services and newly emerging financial and payment solutions to our customers. Additionally, our consulting services can help your organization explore whether servicing the cannabis, CBD, or hemp industry is the right fit for you. FI and Fintech services include, but are not limited, to:

- Education and training on the risks and opportunities of banking the cannabis, CBD, and hemp industries

- Help you detect industry sectors currently operating under the radar in your institution

- Access to proven turnkey and a la carte compliance, reporting, and transaction monitoring resources

- Development of anti money laundering (AML) and know your customer (KYC) protocol

- Referrals to industry-friendly vendors and pre-qualified industry clients

- Consultation and advisory